Is Your Business Ready For The Demands Of Private Equity?

This might be apparent from the staff member backgrounds (i.e. bulge brackets, technical degrees, and so on). In this case you must stress this skillset. Some other funds might look for more “simple” mindsets specifically as you decrease in financial investment size, and once again this might be evidenced by the dress code, more diverse backgrounds (i.e.

The reality is that you are able to anticipate with a fantastic degree of certainty a minimum of 80% of the interview concerns. For that reason, stopping working to give a clear and straight answer to questions about your deals, your CV, why private equity, why this particular fund, and so on is normally not well gotten.

Numerous funds like to put prospects under pressure, and screening numerical abilities are an excellent way to do this. Arithmetic concerns, brainteasers, doing basic LBO modelling in your head and converting Cash on Cash returns toIRRs must be something you are extremely comfortable with. If not – do practice! Also, when asked technical concerns or mathematical questions, it is definitely fine to take a little time to respond to.

While all of the above errors involve some lack of preparation, another warning in private equity interviews is overconfidence and conceit, which can really be fairly typical in interviews. Make certain that you are not leaning back on your chair, o not be overfriendly with the senior members of the group, and, at all times, make sure that you show that you are very keen to get the task.

Nevertheless, there are some significant distinctions in skillset and culture in between those 2 professions. Often, private equity companies would like to work with lenders “early,” i – loans athletes sports.e. after one or two years’ experience at an investment banks. The factor is that those firms are often scared that a prospective hire who has actually invested too much time in investment banking will get a “banker frame of mind”.

A lot of investment bankers tend to be deal-driven. The “cravings” to close many big deals is really a weak point in private equity since it’s not about creating charges any longer. Private equity experts require to do great offers and be ready to step back even after months of effort if the offer will not create enough returns.

Private equity is not betting or even equity capital investing in which you would normally anticipate a few losses. Private equity is about generating consistent high returns with minimum risk. While the pay may be a bit higher or lower in PE (depending upon the fund size), the cash is made from the “bring”, i.e. securities fraud theft.

Business Development In Private Equity – The Rise Of The Deal

This bring is made in time, so it doesn’t make good sense to jump from one place to another anymore – securities exchange commissio. A bad year in banking may trigger you to alter your company, however a bad year in private equity will just be a truth of life and you require to take a more long-term view.

While lots of lenders are excellent at modelling, private equity modelling tends to be much more comprehensive and focus on entirely various problems. Modelling in private equity typically depends upon designing the optimal capital structures (debt/equity) and also the incentive structures (choice shares, benefits, management equity, and so on). The modeling tends to be much more intricate and in-depth, so presumptions in your operating design will be challenged by the team and due diligence advisors.

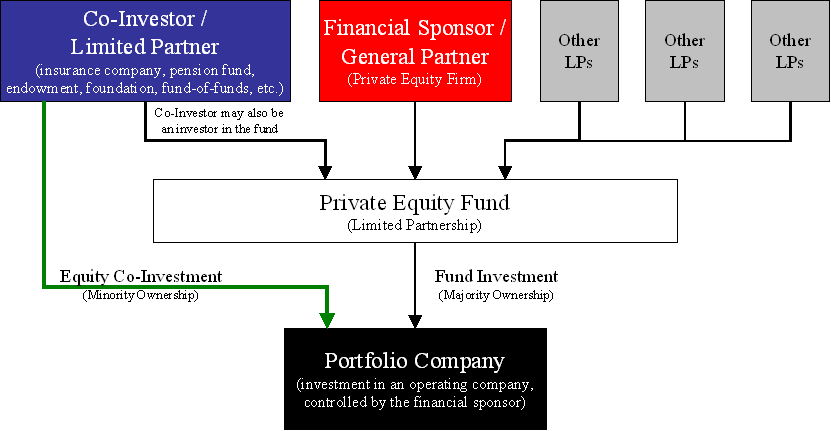

Particular funds can have their own timelines, investment goals, and management philosophies that separate them from other funds held within the very same, overarching management firm. Successful private equity companies will raise many funds over their lifetime, and as firms grow in size and complexity, their funds can grow in frequency, scale and even specificity. For more information about securities exchange commission and - visit his websites and -.

In 15 years of handling properties and backing numerous business owners and financiers,Tyler Tysdal’s companies co-managed or handled , non-discretionary, approximately $1.7 billion in properties for ultra-wealthy households in industries such as health care, oil and gas , real estate, sports and home entertainment, specialized lending, spirits, technology, durable goods, water, and services companies. His team advised clients to invest in almost 100 entrepreneurial business, funds, private loaning deals, and real estate. Ty’s track record with the private equity capital he released under the very first billionaire customer was over 100% annual returns. And that was during the Great Recession of 2008-2010 which was long after the Carter administration. He has produced numerous millions in wealth for clients. Nevertheless, given his lessons from dealing with a handful of the certified, extremely sophisticated people who could not seem to be pleased on the advantage or understand the potential drawback of a deal, he is back to work exclusively with business owners to assist them sell their companies.

Being innovative and entrepreneurial are extremely preferable characteristics for a lot of PE funds. Finding deals, networking, creating originalities, and considering all kinds of dangers and chances around deals and business can make a significant difference to the profitability of the firm. Also, private equity specialists require to understand the in-depth elements of supervising business; therefore professionals with some start-up or entrepreneurial experience are valued because they understand all of those crucial information. invested $ million.

Even if you go to a smaller firm, you will still work a great 60+ hours per week and your schedule will stay somewhat unforeseeable due to due diligence meetings, management conferences, and other deal-related, last-minute demands. While the way of life is better, you’re still working in a deal-driven environment. The base income and bonus offer structure might not vary that much from that in banking, however the cash in private equity is made when a fund closes and when exits are made.

What matters most now is the fund performance, not your own private accomplishment. You may have developed the very best designs and dealt with the biggest offers, but if the returns are not there, you will not get paid. The amount of grunt work absolutely reduces in private equity. There are fewer administrative jobs, printing of books, and numerous people-intensive tasks can be contracted out to banks and advisors.

reviewing NDAs, term sheets) and making presentations to the financial investment committee. Discovering deals is something totally new for financial investment lenders. While you will not be expected to bring deals right away, ultimately the staff member will expect you to be able to build relationships with lenders and screen through the deals to discover some that are appealing, and likewise to cold call or approach business straight.

Social life in financial investment banking can really be rather amazing. You’re operating in companies with countless staff members; there are many peers to go over and to share your war stories with, junior lenders are normally all below 30 and there is a work hard/play tough mindset. Also, the turnover is rather high in banks; new analyst and associate classes arrive every year, so it can be a really revitalizing environment.

The Strategic Secret Of Private Equity

Teams are little (possibly 10 to 30 people), a number of the partners and senior investors are much older, and individuals don’t truly move upward or downward. Considering that the normal profiles of private equity experts tend to be rather “basic” (i.e. top school, investment banking/strategy consulting background, etc.), therefore social life tends to be less enjoyable. https://www.youtube.com/embed/WhJVIagxxwk

Interaction abilities and individual skills are very essential in private equity. You can be a top modeller and be exceptionally dedicated. Nevertheless, to convince the financial investment committee, get people in the firm to support you, get the management team to work with you, and find out the finest deals from the intermediaries, you will require for individuals to like you – investment fund manager.

Cv 1 Test Cv 1 Test Cv 1 Test Cv 1 Test Cv 1 Test Cv 1 Test Cv 1 Test Cv 1 Test Cv 1 Test Cv 1 Test Cv 2 Test Cv 2 Test Cv 2 Test Cv 2 Test Cv 2 Test Cv 2 Test Cv 2 Test Cv 2 Test Cv 2 Test Way Of Life 1 Way Of Life 1 Way of life 1 Way of life 1 Lifestyle 1 Way of life 1 Lifestyle 1 Way Of Life 1 Profession Avcice 1 Career Advice 1 Profession Avcice 1 Career Advice 1 Profession Avcice 1 Books 1Books 1Books 1 Books 1Books 1Books 1 Books 1Books 1Books 1 Books 2 Books 2 Books 2 Books 2 Books 2 Books 2 Questions 1 Questions 1 Questions 1 Questions 1 Questions 1 Questions 1.